Company Profiles

Chilton Trust Isn't Interested In M&A Despite Industry Ferment

We talk to the CEO of a wealth management business serving HNW individuals across the US which expanded last year.

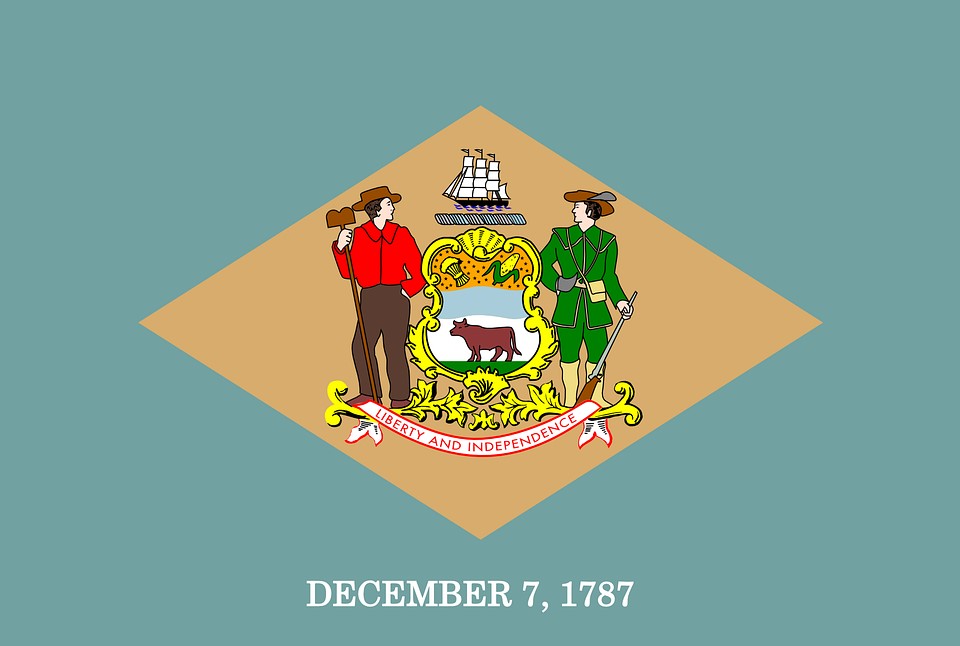

Chilton Trust, a US wealth management house that last year won a National Trust Charter from Delaware to boost its market reach, isn’t interested in mergers and acquisitions, even though many other firms are in corporate marriages right now.

While some firms are growing rapidly via M&A, Chilton is not at all interested in that route, Pepper Anderson, Chilton’s chief executive, told Family Wealth Report in a recent call. (We spoke to her more than a year ago after the National Trust Charter award went through.)

“We don’t need the [M&A] capital to accomplish our goals, as our main goal is our clients and doing great work for them…we can see how private equity is leaning into the space and I wonder about their exits,” Anderson said.

The firm wants to grow but not at the expense of losing its independence, she continued. “I could not be happier with where we sit in the wealth management ecosytem.”

It’s understandable why wealth firms are asked whether they want to sell or buy another business in the present febrile environment. M&A activity has been strong, as illustrated by firms such as Hightower, CI Financial, Mercer Global Advisors, Merchant Investment Management and other prominent acquirers. Much of the action has been among registered investment advisors, with fewer deals on the side of multi-family offices (although some MFOs are regulated as RIAs). Examples of the latter include Tiedemann Advisors’ purchase last year of UK-based Alvarium to build an international MFO. Other MFO deals have included the Tiedemann M&A transactions (Presidio and Threshold); Pathstone (Federal Street, Convergent, Cornerstone) and Fiduciary Trust International (Athena Capital Advisors).

Within the RIA space alone, the industry saw 307 deals in 2021, a jump of around 50 per cent over the 205 deals in the prior year, according to Echelon Partners’ RIA M&A Deal Report. One group of buyers in the space is private equity houses – as Chilton’s Anderson noted above. Seven of the ten most active acquirers last year had PE investors: Focus Financial, Wealth Enhancement Group, Mercer Advisors, Mariner Wealth Advisors, Captrust, Beacon Pointe and Hightower Advisors.

Among recent developments, Chilton Trust opened a new office in Naples, Florida.

Chilton Trust is approaching more than $7 billion in assets under management with approximately 200 family relationships.

Keep calm and carry on

Besides stressing Chilton Trust’s ambition to remain independent,

Anderson spoke about how clients are dealing with volatile

business conditions, hot inflation and the prospect of more rate

rises this year.

“Most of our clients are remarkably calm,” she said, and are using time to review their portfolios. Last year when there were gains in markets, a lot of people were reluctant to realize gains in portfolios. Now they are less stuck," she said. “We are seeing a lot more movement; new business pipelines are more active than they were a few months ago.”

President Joe Biden’s push last year to hike capital gains taxes and other levies on high net worth individuals was stymied in Congress, but, as shown in the past few days, Biden still wants to impose more taxes on top earners. He proposed a minimum tax on billionaires as part of the fiscal 2023 budget. The "Billionaire Minimum Income Tax" would set a 20 per cent minimum tax rate on households worth more than $100 million, in a plan that would mostly target the US's more than 700 billionaires.

Asked about the tax agenda in Washington and the logjam of Biden's tax proposals in the past, Anderson said: “Betting on Washington is always a tricky exercise; it is sensible to realize gains where clients had the appetite, such as where there was over-concentration [in portfolios]. We had a lot of conversations with clients about liquidity, especially near the end of the year.”

FWR asked Anderson about the tight labor market for wealth management talent right now, and the notion of the “Great Resignation” of employees from jobs, hastened by the pandemic experience. She said this idea is a bit hyped.

“The war for talent has definitely escalated in our space…maybe [people] are not as engaged with employers, were closer to clients and talking to them over the phone. Maybe people were feeling less `tethered’. We are looking for great talent.”

People in the “less glamorous” and junior roles in financial services can be hard to find, she said. “There are different, and much more, career options for people today. We are possibly drawing from a smaller pool and need to think more creatively.”

“In this industry we have a tendency to project goals on to people. In reality, people look for different outcomes and different measures of success, such as lifestyle choices,” she said.

Asked about whether younger generations have a possibly over-developed sense of what they are entitled to in work, Anderson said: “I was given flexibility when I needed it but I earned it. It is not a right – it has to be earned. I think you have an obligation to help them [employees] get uncomfortable so they can discover their real strengths and career path.”

Asked about the continued development of robo advisors and how traditional service models are changing, Anderson was positive about technology, but said the idea that it came at the expense of the human factor is not something that works in her sector.

“Robo is amazing because it has made services available to more people than before. There is a level of complexity in certain wealth tiers, however, that requires a bit of a different, `softer’ touch,” she said.

“The real human connection is about looking at someone in the eye…and knowing what is going on in their company, their community…how their kids are doing…it is about building trust.”