This publication has published a number of articles in recent years about the use of insurance-based wealth protection structures. The rise of businesses such as Swiss Life, Lombard International, Cohn Financial Group and Vie, as providers of private placement life insurance , for example, has been a notable trend. With forms of tax planning under assault from revenue-hungry governments, structures that are legally and financial robust in a strong position.

In this article, George Lucaci, partner and senior advisor at Mercury Capital Advisors, the US-headquartered international investments firm and platform, discusses PPLI and private placement variable annuities. The editors of this news service are pleased to share these views; they don’t necessarily endorse all views of contributors and invite readers to respond. Email tom.burroughes@wealthbriefing.com

Despite the wide range of investment options available today, many alternative investment asset classes, including hedge funds and private equity, are not necessarily tax-efficient for individual investors with large investment portfolios.

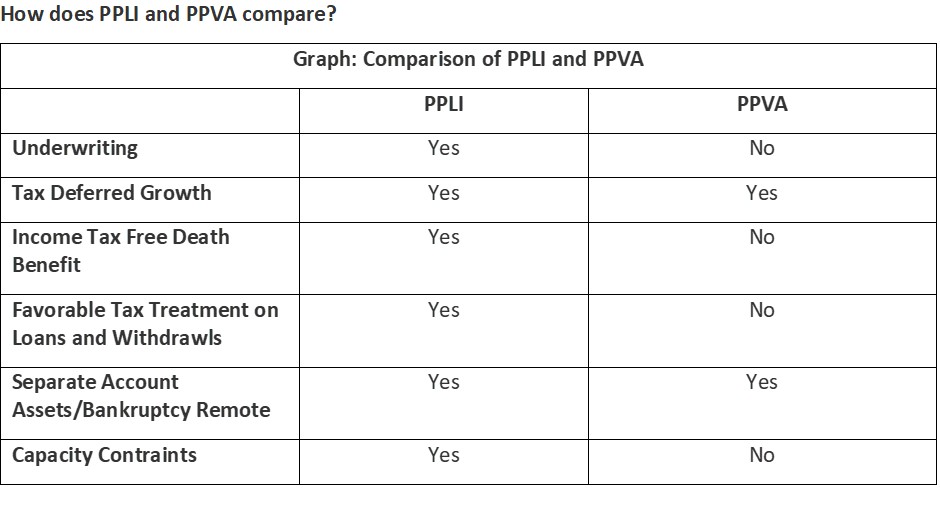

For this reason, there is growing interest among wealth clients for greater access and education to the world of private placement life insurance and private placement variable annuities investment products due to their tax benefits and estate planning opportunities. In this article, we express our opinion and attempt to define and distinguish the benefits and issues of each insurance product, ultimately enhancing the advisors’ suite of tools in their advisory toolkit.

What should an advisor know about PPLI and PPVA?

Compared to traditional retail life insurance funding, private placement life insurance fees are generally lower and typically have no surrender charges. Through private placement life insurance, the accredited investors or qualified purchaser can obtain access and can designate a sophisticated and alternative investment fund or traditional money manager to manage their money, which is then paid into the PPLI policy. Tax-free accumulation of investment earnings, tax-free access to policy assets and tax-free death benefit at institutional pricing provide can provide a helpful planning tool for advisors to offer to wealthy clients.

Similar to the lower cost benefits of private placement life insurance to traditional retail insurance products; private placement variable annuity investment accounts can be beneficial for investors interested in investing in non-registered investment offerings . Investors can defer investment gains distributed from the private placement variable investment account to be taxed as ordinary income. This can primarily be beneficial for individuals that intend to retire to a lower tax jurisdiction, families with a large investment allocation to alternatives and those that upon passing plan to leave assets to a public charity or private foundation.

How can advisors and wealth intermediaries obtain access to these policies?

Through financial technology platforms, such as Mercury Capital Advisors iFunds, qualified purchasers and accredited investors can gain access to these types of policies. Offered through two types of subscriptions private placement life insurance and private placement variable annuity investment accounts are offered through a streamlined or customized subscription process.

In a streamlined subscription process, the investor may choose from a fixed menu of insurance dedicated funds with no medical underwriting required. In a customized subscription process a wealth advisor may design an insurance dedicated separately managed account, which is a customized IDF, built specifically for one or multiple clients.

While the opportunity for investors has significant tax benefits and estate planning opportunities, from an advisor perspective the ability to create and offer customized solutions to clients is a central component of being accessible and relevant to a diversified client base.