This news service and its sister publications have produced a few articles recently on the subject of passive investing, and whether this trend in managing money may have hit a peak, or is in need of being re-examined. To some extent the very use of the word “passive” can be misleading because even a decision not to buy and sell individual securities but to follow an index is a decision, not simply a reflex. Any choice to act, even if it is to go for a low-cost index fund rather than chase “Alpha” through some exotic vehicle, is a choice - it involves activity.

There is no doubt, however, that more than nine years into a bull market in stocks and with signs of investors getting nervous about market reversals or corrections, that more people are starting to ask whether the trend towards passive investment might hit some troubles of its own. This news service is therefore happy to share the views here of Roger Jones, head of equities at asset manager London & Capital. L&C is a wealth management house that, among other features, is known for specializing in the money management of people with interests and connections to the US. The views of such guest contributors are vital for debate; editors at this news service don’t necessarily share all such views and invite readers to respond. Email tom.burroughes@wealthbriefing.com

The rapid and continued rise of passive investment and exchange traded funds is the success story of the last decade of asset management. A recent study demonstrated the rocketing AuM in passive funds, growing from 11 per cent of global AuM in 2008 to 18 per cent in 2016 and projected to reach 20 per cent in 2021. It has now reached the point that “ETF of ETFs” type funds are available to investors. This explosion of passive investment has brought with it an unprecedented and dangerous level of market correlation, introducing systemic risk.

Passive investment works best during strong markets, subsequently they have appeared very attractive during recent history, with equities having been on a sustained bull-run since 2010. Further to this, the most recent economic recovery has seen passive investments benefiting from Central Bank quantitative easing, which has reduced volatility, distorted financial markets and undermined the fundamental analysis that drives stock and bond performance.

This long period without any significant shock to passive investors may have given them a false sense of security. When the markets turn and volatility increases, those with passive investments will have limited options. Their investment providers will have no choice but to chase the indices lower, their strategy and reliance on market tracking funds has no room to maneuver. They can only invest in the falling market.

A situation like this may be rapidly approaching. As central banks wind down their asset purchase programs and the current bull-run looks like it is drawing to a close, passive investors will be exposed to volatility and market corrections. The current geopolitical chaos may bring this on sooner rather than later. With an unpredictable Trump administration looking less tenable by the day and the confusion and disagreement surrounding Brexit continuing, any resulting associated market shock could cause passive investors to reconsider their strategy.

Despite this, investors are still drawn to passive by the low fees and the comparative underperformance of active managers reported in recent years. If the performance of active funds is lower than that of passive strategies, there is no incentive to invest in them.

Certainly, there is some validity in this mindset. Perhaps the most damning statistic raised against active investment is that 90 per cent of active asset managers have failed to beat their benchmarks over the last one, five and ten year periods. Undoubtedly this is a failure to such an extent that some responsibility must be taken, however it is a figure that will have been distorted by the prevalence of closet trackers - managers who charge an active fee, but in practice, stick very closely to their benchmarks, giving index-like performance. This approach can clearly not be considered true active investment.

Due to a lack of transparency it is currently unclear quite how much this will have affected the figures above, however with investors such as Schroders, Fidelity International, JP Morgan, Henderson and Amundi having been named in a recent list of potential closet trackers, it is clearly not insignificant.

The approach of tracking an index, whether through ETFs or closet trackers, would appear to provide effective diversification and risk management. In practice, however, the presence of such high market correlation actively works against this as risk becomes concentrated in certain companies and sectors. For example, investors in an ETF tracking the S&P 500 will find more than 10% of their investment going towards the five FAANG stocks, with almost 23% going to the technology sector as a whole. As a result of this, any change in tech stock sentiment will have a disproportionate impact on the ETF.

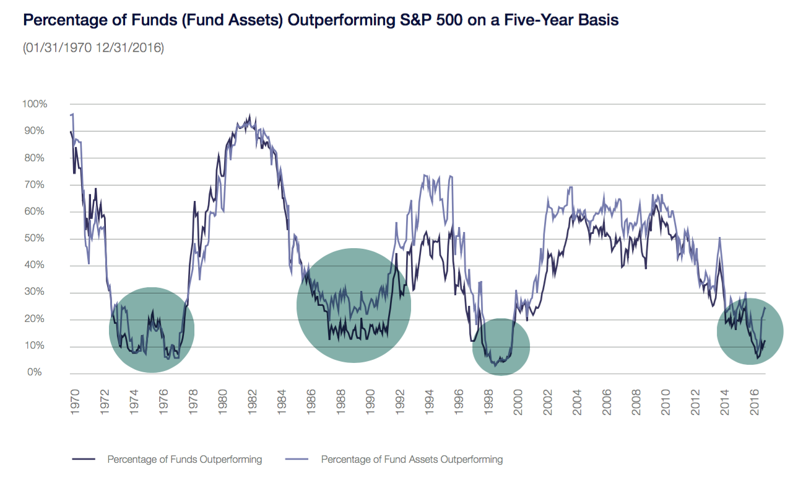

For those still fixated on the poor investment returns offered by active management in recent years, historical analysis shows a clear cyclicality in active and passive investment returns. As shown below, similar levels of underperformance to those currently being experienced come about on a regular basis, along with their corresponding returns to better health. Early in the investment cycle, passives have the opportunity to thrive as stocks recover and the disparity in performance between them is minimal, limiting active investment opportunities. Later in the cycle, active strategies will begin to fare better. As higher levels of volatility and periods of market correction return, they bring with them a greater benefit from selective investment decisions.

Source: Nomura Instinet, Joseph Mezrich

Passive investment certainly has an important role to play. With low costs, ease of use and strong recent performance, it is doubtless an attractive proposition for new investors. Used in conjunction with other investment strategies, it can form part of an effectively diversified portfolio. It is, however, an incomplete investment solution, concealing risks and introducing bias. For investors with complex needs and a wish to continue growth, minimize downside risk and preserve capital effectively, a carefully selected, reputable active manager with a strong track record will navigate volatile economic and market conditions in a way in which a passive strategy simply cannot.