Wealth Strategies

Quick-Service Restaurants Belong On Investment Menu

Ever thought of investing in a restaurant and decided against it? That can be an understandable reaction given some of the headlines about failed ventures. That does not mean the sector is a no-go for those able to take a diversified approach in certain areas, according to the author of this article.

The business pages are littered with stories of how risky it is to try and make money in the restaurant trade. But perhaps some food outlets are riskier than others, and if a portfolio approach that emphasizes diversification is adhered to, putting money into restaurants might make sense after all, depending on one’s appetite for risk.

To consider such an idea is Dan Fletcher, of iCapital Network, a platform that gives access to alternative investments such as private equity and in a way that it says helps democratize access to assets that have been previously the preserve of the super-rich.

The editors of this news service are pleased to share these insights and invite readers’ responses. As always, the usual editorial disclaimers apply (see another disclaimer below the article). To respond and jump into debate, email tom.burroughes@wealthbriefing.com or jackie.bennion@clearviewpublishing.com

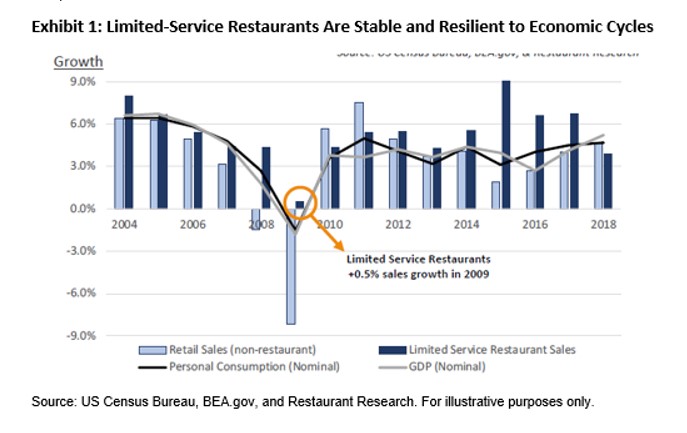

When seeking out recession-resistant investments, the restaurant industry may not be the first place investors look, but they could be missing an opportunity. Certain categories within the restaurant industry, most notably quick service restaurants and fast casual restaurants, offer affordable menus that often lead to stable consumer demand, even under weak economic conditions.

In fact, consumers may be more likely to eat at QSRs and FCRs during a recession, as they are inexpensive and convenient. During the global financial crisis, these restaurants proved to be attractive investment options, as they exhibited modest sales growth even as the rest of the economy contracted (Exhibit 1). (1).

Trends shaping the restaurant investment

opportunity

In addition to their relatively resilient nature, the QSR and FCR

segments of the restaurant industry are poised for significant

growth in the coming years, thanks to several overarching

trends.

Consumers have less time to cook

Americans lead busier lives than ever and have less time for

traditional household activities. According to data

published by Pew Research in June 2019, the percentage of

dual-income households in the US has risen to 66 per cent, up

from 49 per cent in 1970. (2) Technology is also keeping American

workers connected to their jobs during all hours of the day,

while children face growing pressure to partake in numerous

extracurricular activities.

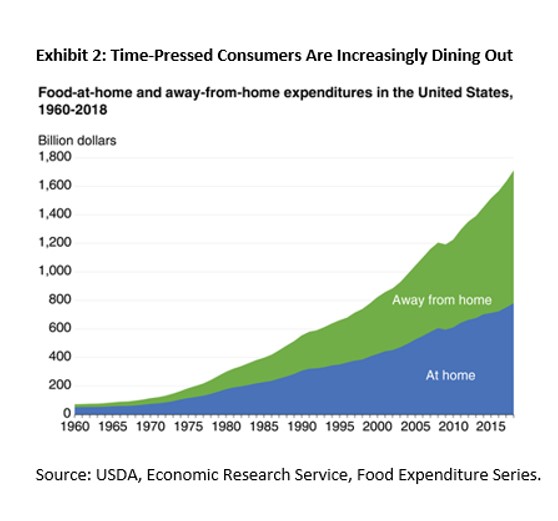

For many families, the solution to this challenge has been to cook less (historically reported as the most time-consuming domestic task) (3) and dedicate more income toward take-out and delivery. Data from the USDA shows that food-away-from-home accounted for 54 per cent of total food expenditure in the US in 2018, up from 50 per cent in 2009, and around 25 per cent in the 1950s (Exhibit 2). 4 This trend is particularly pronounced among younger consumers, as eating out represents a greater share of total food spend for each successive generation. (5)

QSRs and FCRs are expanding menu options for

health-conscious consumers

Many restaurants have updated their menus with items designed to

attract different types of customers. The addition of menu

options that are perceived to be healthier, for example, makes

quick service restaurants more attractive to health-conscious

consumers who might otherwise not buy fast food. Numerous fast

food chains now offer menu items that are food-allergy friendly

or aligned with popular diet trends, which has allowed these

businesses to broaden their addressable markets. Additionally,

the fast food industry as a whole offers consumers a variety of

options, ranging from burgers to pizza to Mexican cuisine,

further enhancing the appeal for consumers.

Technology offers easier food delivery and provides

additional revenue opportunities

Technology developments in the food service industry have made

dining out (or in) easier than ever. The rise of startups such as

DoorDash, Postmates, and Uber Eats has made meal delivery simpler

and more efficient. This has led to a surge in online and mobile

ordering. By 2020, food delivery app usage in the US is projected

to surpass 44 million people and reach nearly 60 million people

by 2023. (6) The global market for online food delivery is

expected to grow to $365 billion by 2030, representing a 20 per

cent CAGR from 2017 levels. (7)

Further, operators continue to invest in technology to generate additional revenue opportunities and improve profitability. Nearly 50 per cent of restaurant chains intend to increase their technology spending over the next year, (8) with much of that investment going toward artificial intelligence (AI). Several prominent brands are implementing AI to power their online ordering service with chatbots. Many operators are also installing ordering kiosks with AI engines to reduce customer wait times and implement targeted selling, where the systems detect ordering patterns to generate suggestions for additional items.

Finally, technological innovations have helped restaurant owners improve their margins by becoming more efficient in the way that they track food costs and manage their supply chains.

Demand for capital

Growth across the industry has led to a high demand for capital,

with a total financing need across the sector estimated to range

from $15 billion to $20 billion annually. (9) Within the

quick-service and fast-casual segments, several recent trends are

reshaping the competitive landscape and driving the need for

capital. Most notably, many large brands have gravitated toward

supporting a smaller number of franchisees, favoring proven

operators who can deliver strong results across a large portfolio

of locations. As a result, franchisors have been actively buying

locations from weaker operators and selling them back to stronger

ones, who often require financing options to complete the

transactions.

Investment structuring

Many franchise operators have shown a preference for non-dilutive

financing, opting to take on debt rather than equity investments.

This has proven to be an attractive proposition for potential

investors, as it allows them to invest in senior secured loans,

which mitigate downside risk. Such loans are often privately

negotiated and therefore lack a liquid secondary market. However,

they typically provide current income from contractual interest

payments, often at a premium to yields from public fixed income

securities, allowing investors to realize returns more quickly

than they would from private equity investments.

Quick service and fast casual restaurants: A late-cycle

diversification opportunity

Food and beverage products elicit daily demand regardless of

business cycles, as consumers continue to eat three times a day

even when their incomes are squeezed. In fact, the low-cost

nature of limited-service restaurants often makes them more

attractive during difficult financial times. As investors look

for ways to diversify their portfolios to protect against a

potential recession, the QSR and FCR segments should provide low

correlation to the broader economy while offering meaningful

growth potential.

Footnotes

1, Source: US Census Bureau, BEA.gov & Restaurant

Research

2, Source: Pew Research Center, “8 Facts about American

Dads,” June 2019.

https://www.pewresearch.org/fact-tank/2019/06/12/fathers-day-facts/ft_17-06-14_fathers_dual_income-2/

3, Source: Bureau of Labor Statistics, as of 2018.

https://www.bls.gov/charts/american-time-use/activity-by-hldh.htm

4, Source: United States Department of Agriculture, as of

2018.

https://www.ers.usda.gov/data-products/chart-gallery/gallery/chart-detail/?chartId=58364

5, Source: CapitalSpring Industry Update Q4 2018: Food Away

from Home on The Rise; US Department of Labor

6, Source: eMarketer, 2019.

7, Source: UBS, “Is the Kitchen Dead,” June 2018.

8, Source: 2018 Hospitality Technology Magazine.

9, Source: Restaurant Research Finance & Valuations – 2019.

Estimates only for $1 billion chains and their franchisees - $11

billion of financing needs for 2018, including real estate

financing. CapitalSpring estimates subordinated debt, equity, and

refinancing needs of $4-9 billion annually.

IMPORTANT INFORMATION

This material is provided for informational purposes only and is

not intended as, and may not be relied on in any manner as legal,

tax or investment advice, a recommendation, or as an offer to

sell, a solicitation of an offer to purchase or a recommendation

of any interest in any fund or security offered by Institutional

Capital Network, Inc. or its affiliates (together “iCapital

Network”). Past performance is not indicative of future results.

Alternative investments are complex, speculative investment

vehicles and are not suitable for all investors. An investment in

an alternative investment entails a high degree of risk and no

assurance can be given that any alternative investment fund’s

investment objectives will be achieved or that investors will

receive a return of their capital. The information contained

herein is subject to change and is also incomplete. This industry

information and its importance is an opinion only and should not

be relied upon as the only important information available.

Information contained herein has been obtained from sources

believed to be reliable, but not guaranteed, and iCapital Network

assumes no liability for the information provided.

Products offered by iCapital Network are typically private placements that are sold only to qualified clients of iCapital Network through transactions that are exempt from registration under the Securities Act of 1933 pursuant to Rule 506(b) of Regulation D promulgated thereunder (“Private Placements”). An investment in any product issued pursuant to a Private Placement, such as the funds described, entails a high degree of risk and no assurance can be given that any alternative investment fund’s investment objectives will be achieved or that investors will receive a return of their capital. Further, such investments are not subject to the same levels of regulatory scrutiny as publicly listed investments, and as a result, investors may have access to significantly less information than they can access with respect to publicly listed investments. Prospective investors should also note that investments in the products described involve long lock-ups and do not provide investors with liquidity.

Securities may be offered through iCapital Securities, LLC, a

registered broker dealer, member of FINRA and SIPC and subsidiary

of Institutional Capital Network, Inc. (d/b/a iCapital Network).

These registrations and memberships in no way imply that the SEC,

FINRA or SIPC have endorsed the entities, products or services

discussed herein. iCapital and iCapital Network are registered

trademarks of Institutional Capital Network, Inc. Additional

information is available upon request.