Alt Investments

The Case For Including Private Equity In Portfolios

.jpg)

As access to private equity gets “democratized” there are more opportunities for HNW investors to tap into the asset class. However, this does bring some additional risks that should be understood.

Private equity, once seen as a specialist asset class suitable only for large institutions or ultra-high net worth individuals, has broadened out its appeal in recent years, even though it is some way off from being a mainstream asset class. With yields on listed equities and other more conventional assets staying low – partly the legacy of a decade of ultra-low interest rates – enthusiasm for private equity is easy to understand. Private equity is less liquid than some assets – hence the premium – and the way that performance is measured differs radically from, say, measuring the S&P 500.

In this article, Lacey Cobb, director of advice solutions at Personal Capital, takes a tour around the private equity landscape. We hope readers find these observations useful and invite responses. The editors don’t necessarily endorse all views of guest writers. To comment, email tom.burroughes@wealthbriefing.com

In recent years, there has been increased interest among high-net-worth investors around adding alternatives, such as private equity, to their portfolios. Access to the private markets has historically been limited to large institutional investors and out of reach for most individuals. However, new technologies have begun democratizing access to private equity and unlocking opportunities for more investors in this space.

Companies like iCapital, Artivest, and CAIS Group offer

technology platforms that enable investors and advisors to

research investment opportunities and invest at lower minimums.

This is done through feeder funds which are vehicles that pool

capital and invest in underlying private equity funds. Their

platforms also contain several resources for investor education.

Most attractive solutions still require investors to be Qualified

Purchasers, with a liquid net worth of at least $5 million. With

innovation comes an evolving market landscape that requires

vigilance for new investors looking to adapt.

At Personal Capital, we support the expansion of access to

private equity opportunities. We also recognize the complexities

of private equity and that it is not suitable for many investors.

Our views here assume an individual’s financial situation,

investment objectives, risk tolerance, time horizon, liquidity

needs, and level of investor sophistication have been assessed to

determine appropriateness.

The case for inclusion

Adding private equity to an already diversified portfolio can

increase return potential and enhance diversification. Private

equity has several differentiating characteristics that make it a

compliment to a traditional portfolio. Investors demand a higher

return for the illiquid long-term investment period and managers

demand higher fees for their active role in the investment. The

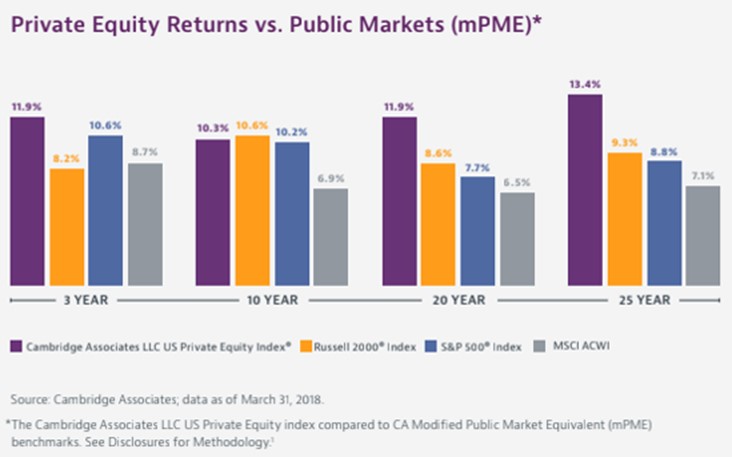

chart below shows the outperformance of private equity after fees

over time when compared to public markets, according to Cambridge

Associates.

When comparing public vs private equity returns, due to

fundamental differences in performance calculations, investors

should use a public market equivalent benchmark. Internal rate of

return “IRR” is the industry standard for private equity

performance reporting because it accounts for the timing and

amount of cash flows. When comparing performance of managers,

investors should look at IRR and only compare funds of the same

vintage year.

Unlike public markets, where company information is readily available and well-priced in, private equity offers the appeal of relatively exclusive opportunities in less efficient markets. A private equity manager’s personal network and skill are valued at a premium in order to identify and source the best opportunities. Naturally, this can create conflicts of interest from the informational asymmetries that exist in private markets, so it is important to make sure the terms of an agreement are aligned and fair, and that the manager has been properly vetted. Asymmetric information risk can be minimized by structuring the agreement as a limited partnership and including a preferred rate and claw back provisions to further decrease the risks. A manager who is willing to take their compensation heavily weighted toward performance and with Limited Partner-friendly covenants, is confident in their abilities, naturally decreasing asymmetric risks and improving risk adjusted return potential.

Addressing overcrowding

Private equity’s rising popularity has also brought with it a

record amount of dry powder or cash waiting to be invested, now

estimated to be at over $1 trillion as of Q4 2018, according to

Preqin, which has sparked concerns of overcrowding. These

concerns are not unwarranted, but it is important to dive a

little deeper into the not so obvious causes. A long period of

accommodative monetary policy and low interest rates has been one

factor for the increase in popularity of alternatives. The long

bull market in public equities means portfolio managers must

commit more capital to maintain private equity target

allocations. This, along with a general increase in the investor

base as private equity becomes more institutionalized and

available, has driven the record numbers.

However, what people often don’t realize is the magnitude of the investment universe of private companies. Per the National Bureau of Economic Research, publicly traded companies make up less than 1 per cent of all US firms. The number of public companies has been cut roughly in half since 1996. Successful new companies are now staying private longer.

This does not diminish the fact that supply and demand is important in all markets. Expected return for private equity should be less than what it was in the early years with limited players, but that is a natural market development to be expected as more investors enter the market. We still expect to see private equity slightly outperform public markets over long periods of time, mostly attributable to the illiquidity premium.

Addressing cyclicality

Cyclical concerns related to the economy are a risk for both

public and private equities, but private investing carries a few

additional risks. By maintaining proper diversification both

within a private equity allocation and holistically over your

entire portfolio, the risk adjusted return can be maximized. This

requires taking a prudent approach to private equity, such as

building an allocation over several years and with a proper mix

of managers and strategies, along with proper management of

overall exposure. The importance of diversifying an allocation

over multiple vintage years cannot be overstated as it helps

balance out the cyclical exposures in the portfolio. It is also

worth pointing out that the illiquid nature can provide stability

to a portfolio when public equity market volatility picks up by

decreasing the risk of emotional reactions to market movements.

Importance of education

It’s a positive evolution that private equity can now be made

available to more high-net-worth investors seeking higher returns

and diversification. However, it’s important that both advisors

and investors are fully educated about the asset class, as there

are still too many high-fee managers adding little or no value

and too many brokers charging high commissions for “access”. We

firmly believe in a fiduciary approach and strongly encourage

those considering the asset class to research and perform their

own due diligence. There is widely available information online

from Cambridge Associates, Preqin, CFA Institute, CAIA

Association, and several other reliable resources for individuals

and professionals alike.

Disclosures

Any reference to the advisory services refers to Personal Capital Advisors Corporation, a subsidiary of Personal Capital Corporation. Personal Capital Advisors Corporation is a registered investment advisor with the Securities Exchange Commission (“SEC”). SEC registration does not imply a certain level of skill or training. Past performance does not guarantee future results. All investing involves risk of loss including the possible loss of all amounts invested. Private equity is not an appropriate investment for all investors and comes with additional risks and higher fees, and is highly speculative. Private equity is only suitable for investors who have a certain degree of financial expertise and sophistication and who are able to evaluate the benefits and risks of this type of an investment.

Note

¹ Source: Cambridge Associates. The Cambridge Associates LLC US Private Equity Index® is a horizon calculation based on data compiled from 1,468 US private equity funds (buyout, growth equity, private equity energy and subordinated capital funds), including fully liquidated partnerships, formed between 1986 and 2017. Private indexes are pooled horizon internal rate of return (IRR) calculations, net of fees, expenses, and carried interest. The timing and magnitude of fund cash flows are integral to the IRR performance calculation. CA Modified Public Market Equivalent (mPME) replicates private investment performance under public market conditions. Public Market Equivalent benchmarks are considered the more accurate comparison for private investment performance relative to public markets (see methodology below). Constructed MSCI All Country World Index: Data from 1/1/1986 to 12/31/1987 represented by MSCI World index gross total return. Data from 1/1/1988 to present represented by MSCI ACWI gross total return. Sources: Cambridge Associates LLC, Frank Russell Company, Global Financial Data, Inc., MSCI Inc., Standard & Poor’s, and Thomson Reuters DataStream.

Methodology: The public index’s shares are purchased and sold according to the private fund cash flow schedule, with distributions calculated in the same proportion as the private fund, and mPME NAV is a function of mPME cash flows and public index returns. This adjustment is made because public indexes are generally average annual compounded return (AACR) calculations, which are time-weighted measures over the specified time horizon. Due to the fundamental differences between the two calculations, direct comparison of IRRs to AACRs is not recommended; therefore, we have elected not to show it.