Client Affairs

RBC Wealth Management Joins WealthiHer Table

RBC Wealth Management is pushing its credentials as a female-centric manager as a number of recruiting and awareness campaigns are beginning to bear fruit.

RBC Wealth Management is among many in the sector studying how to reach female investors and bring more diversity into the advisory pool. This week the group joined the WealthiHer Network, set up a year ago to boost the representation of women and support their financial needs across the sector.

Women are overwhelmingly becoming responsible for the family investment portfolio and generally making household wealth decisions. Statistically, they contribute around $8 trillion annually to the US economy but lag behind men in financial confidence. Some of this is down to lack of female advisors to relate to, and research bearing out that their investment approaches are far more goals driven.

Joining the WealthiHer Network is one way to join forces and raise awareness. "It is a great opportunity to be at the forefront of celebrating, inspiring and empowering female clients,” Annabel Bosman, head of relationship management at RBC WM said, adding that the sector is starting to see "real progress.”

In the last couple of years, the wealth manager which administers around $714 billion in assets and is part of Toronto-based Royal Bank of Canada - the country's biggest - has launched a broadside effort to widen its talent pool, including releasing a series of video stories of women sharing their journeys into wealth management, where no two paths are the same.

In one account, a non-profit fundraiser, describes becoming a Minneapolis chef, then turning 40 deciding to retrain as a financial advisor. The visual storytelling has been a success, those behind the campaign told Family Wealth Report in a call last week about tangible progress. Since its launch, the number of female advisors at RBC is up by 23 per cent and its female branch managers have doubled, the group said.

“The first series focused on our financial advisor base of approximately 2,000 advisors, where we really wanted our field-facing employees to reflect the diversity of the population," said communications director, Nicole Garrison. Women were the focus of the first series, "then, last fall, we launched the second series focused on diversity more broadly in terms of race, ethnicity, and orientation to really encompass all diversity,” she said. That trend has continued, with the first quarter of 2020 showing that 25 per cent of new recruits into financial planning at the firm are female.

The statistical picture around women is getting hard to ignore. The National Center for Education reports that women have earned the majority of college degrees since the early 1980s and, as entrepreneurs own roughly 10 million US businesses, employing around 8 million people. This year, women are expected to control $72 trillion, a third of all wealth, with Boomer women now potentially controlling the buying power across four or five generations.

Casting its net in that direction, RBC launched a women-in-wealth hub in March to give women "comprehensive access" to their financial health and get them thinking about their relationship with money.

“All the data is put in by the individual client so it becomes completely customized to their specific goals," said Kristen Kimmell, head of advisor recruiting and field marketing at RBC, describing the main wealth-book tool. "In a volatile market, clients always have the ability to go in, not to look at how they are performing in the volatility but rather, ‘Am I still on track to achieve my goals?", she said. There is also a play zone that allows women to do 'what if' modeling, as in "‘what if I decided to retire three years earlier or work two years longer?" she said. The 2020 launch of the service also marks a hundred years since women were given the vote in the US, which "has precipitated all sorts of economic and financial gains," Garrison added.

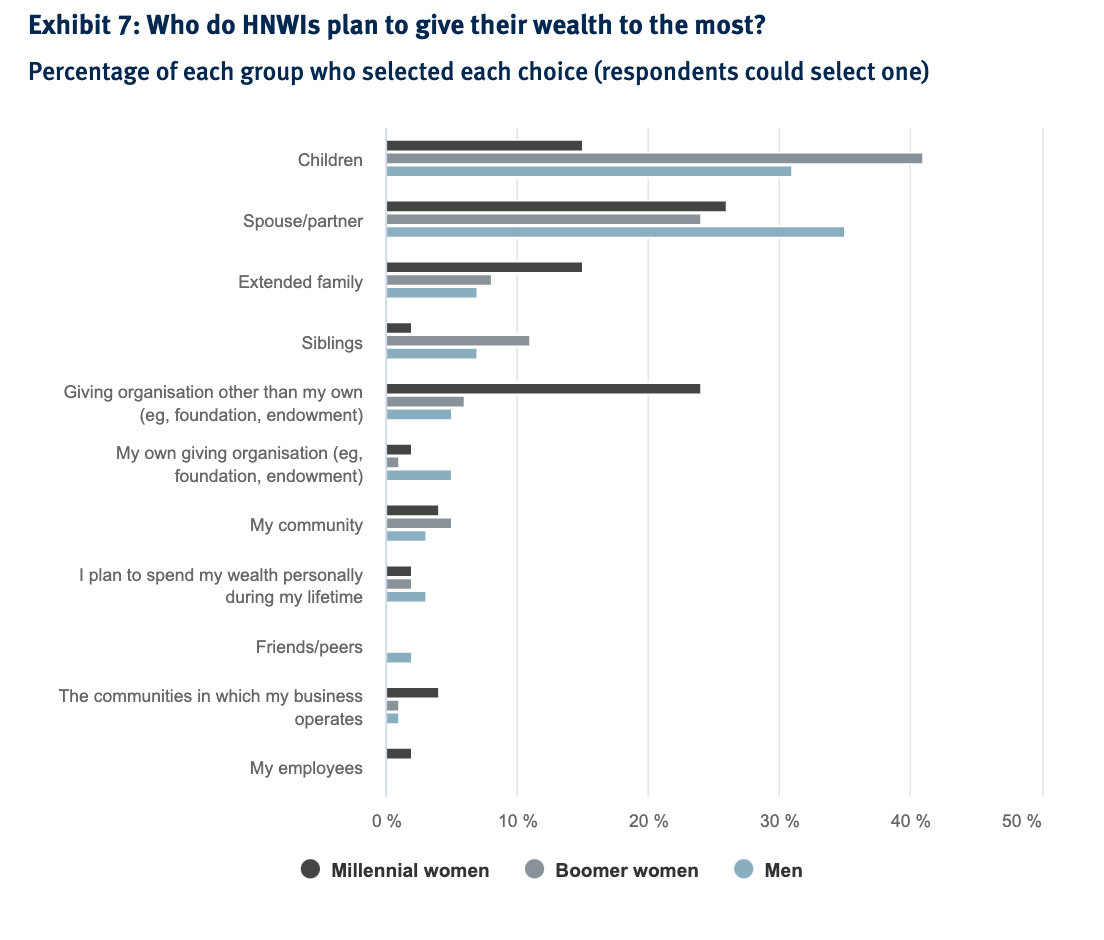

The fact that many more Millennial women today are attributing their wealth to business rather than inheritance is also stoking urgency for wealth planners to adapt. As a result, far fewer Millennial women are intending to give their fortunes away to their children - just 15 per cent compared with 40 per cent among Boomer females, according to a broad survey of HNW and UHNW women by RBC and the Economist Intelligence Unit.

“In the US, we’re seeing women marrying later and building wealth on their own, and that’s native to Millennials. It certainly wasn’t something that my generation went through,” said Angela O’Leary, head of wealth planning for RBC in the US. “They have their own careers, they’ve made their own money, they have their own 401(k), and many of them are starting to buy their own homes before they’re even married.”

Also in the armory, RBC sponsors training programs at universities and high schools and relies heavily on social media to target women who may be planning to change career or re-enter the workforce. Diversity in those training programs is up between 35 and 40 per cent, the firm said.

To catch college students as they weigh career choices, the firm also runs an ambassador program nationwide. “I go onto campus and start talking about financial services and I look like their mother, but if one of their peers is talking to them about what a great career path they are experiencing, it tends to resonate more,” Kimmell said. The group has paired with the CFC program at the University of Madison as one example. “Part of it is having branch volunteers in that location helping develop the curriculum and participate in some of the training experience in-branch as well,” Kimmell said.

In high schools, the wealth manager works with Rock the Street Wall Street, an organization that works alongside financial services firms willing to donate time and funding to educate younger students. RBC runs eight-week early-learning programs to educate girls specifically about “the basics of investing, budgeting, the importance of retirement planning early in their careers, and the benefits of working with financial advisors,” Kimmell said.

Before the course “many of them hadn’t heard of a financial advisor. One of the girls said, ‘I shared a budget exercise with my parents at home and it felt exciting, because we’ve never talked about money like that in our home before.’ It is raising financially competent women as well as giving visibility to careers in the financial sector,” she said.

RBC is the 15th member to join the WealthiHer Network highlighting female financial wellbeing. The other charter members are Barclays Private Bank, Brewin Dolphin, Brown Advisory, C5 Capital, Chubb, Close Brothers Asset Management, Federated Hermes, HSBC Private Banking, Investec Private Banking, JP Morgan, Julius Baer, Kleinwort Hambros, Reddings Wealth Management and Irwin Mitchell solicitors.

A number of major banking groups in the US have also sworn to ramping up diversity efforts, through a mix of approaches. Merrill Lynch Wealth Management has rolled out a national talent program and supports the Center for Financial Planning in its efforts. The organization, heavily backed by industry, including lead sponsor TD Ameritrade, is focused on changing the complexion of financial services. Since 2016, it has reported a 66 per cent increase in the number of CFP professionals aged under 30 and doubled the number of women becoming CFP-qualified to more than 4,000 in that period.

Wells Fargo parent Abbot Downing and UBS are two hitting the issue hard through their wealth manager, planning and advisor programs. UBS has partnered with careers and recruitment specialist Jopwell in some of its efforts to source and train a new generation of advisors.

"Diversity is all encompassing - we look for a diversity of thoughts, experiences and backgrounds. The consistent theme we focus on is quality - we are looking for top talent, with a track record of success across diverse backgrounds and experiences,” said Emily de la Reguera, who started as a graduate trainee at UBS and now heads next-generation advisor development for the Swiss wealth manager.

Women are also driving how money is given. The EIU/RBC survey showed that 81 per cent of them want their wealth planning fully aligned with their legacy. “The vast majority of philanthropy is guided by women in the US,” O’Leary said, noting that women generally outlive men, putting them solely in the driving seat for controlling how wealth is transferred.