Alt Investments

Private Equity "Runs Hot" - Study

The annual survey of the sector shows no let up in appetite for private equity deals, with ESG and special purpose acquisition companies playing a greater role. Private market investment surge brings its own problems.

The latest survey of private equity deal-making from global law firm Dechert shows that a record US$1.17 trillion in deals were struck between January and September 2021, out-performing all full-year results since 2015.

Private equity transactions in Asia-Pacific more than doubled in value for the period year-on-year. Technology and media and telecoms (TMT) led the pack, taking 43 per cent of all transaction values in the region, followed by healthcare and consumer deals. Findings also showed a marked rise in the use of private credit to finance buyouts.

The figures are drawn from the Global Private Equity Outlook survey. The benchmark report, conducted by data provider Mergermarket, examines how private equity firms are navigating their way out of the pandemic and shows the level of deal making activity.

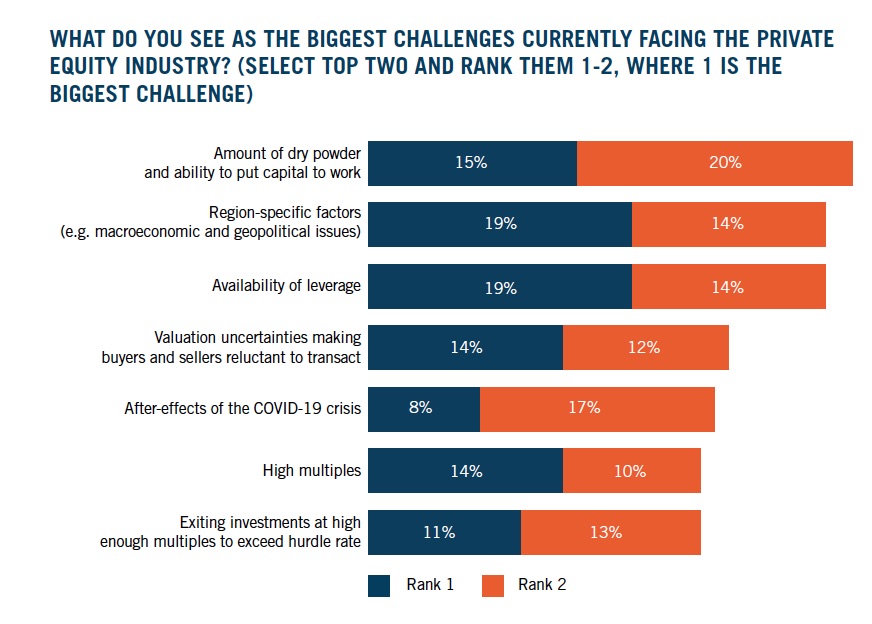

More investors turning to private markets for yield and diversification have pushed demand for alternative assets, with the report indicating that PE is on course to blow through previous records. Dry powder in venture capital and PE globally hit record levels of nearly $2 trillion in 2020. More than a third of respondents this year flagged the amount of dry powder and the ability to put capital to work as one of the biggest industry challenges. The following graph shows how limited partners ranked.

Several other trends are shaping deals. The first is the rise of ESG and stakeholder pressure mounting on private companies to follow in the footsteps of listed companies to pursue their ESG accountability more closely.

Dechert results show that Europe and the US continue to lead on ESG, but Asia is closing the gap, with two-thirds of APAC participants saying that they expect ESG scrutiny and reporting to increase among limited partners over the next three years.

SPACs on the rise

A second trend is the rise of special purpose acquistion

companies, or SPACs. Although SPACS are relatively new to Asia,

the report suggests that investor demand, coupled with a desire

to attract more high-profile tech listings, is changing that.

Both Singapore and Hong Kong are speeding up access. Singapore

has already introduced a SPAC listing framework and Hong Kong is

about to follow.

For those companies which have not been able to achieve secondary exits, SPAC mergers are now “a very viable exit option,” Siew Kam Boon, a private equity partner in Dechert’s Singapore office, said.

Divergence emerges

This year's report identified that larger well-established

players, including multi-strategy asset managers, are diverging

from their smaller lesser-known counterparts, making it

increasingly hard for new entrants to establish a foothold, the

report said.

"This trend was already playing out prior to 2020, but the pandemic has exacerbated it. Travel restrictions benefited established managers as capital went to those firms with a bounty of strong, existing LP relationships. Conversely, first-time funds accounted for only 16 per cent of closes in 2020, according to Preqin, the lowest level in a century," the report authors wrote.

It also suggested that the sheer size of transactions is likely to revive club-style deals in the US as the traditional home of PE megadeals; 53 per cent of North American general partners said they expected to see this trend grow in the wake of the pandemic. Just 37 per cent and 30 per cent, respectively, from EMEA and Asia-Pacific, thought the same.

In terms of deal flow, Asia saw $199.6 billion of buyout activity during the period, with nearly half of those reported in Q2. The region has $385 billion yet to be allocated, according to the report.

"Record deal volumes, historically low interest rates and huge amounts of dry powder is a combination for explosive alternative asset industry growth, which is expected to continue for several years,” Markus Bolsinger, co-head of Dechert’s global private equity practice and partner in the firm’s New York and Munich offices, said.

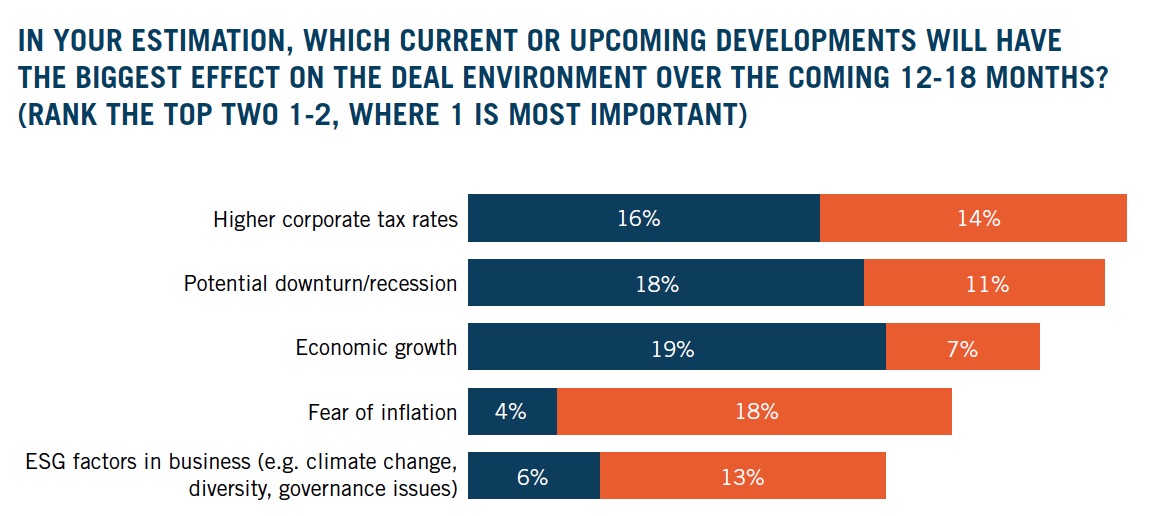

“Additionally, the areas with the most growth, TMT and pharma/medical/biotech are, together with financial services, another growth area, among the sectors in which Dechert’s PE team has been most active in deal making,” he said. This chart shows the top five concerns for deal disruptions in the next 12 to 18 months.

Climate top concern

Pinpointing key investment themes, 29 per cent of respondents

singled out climate change as the most important ESG

consideration, followed by 14 per cent choosing sustainability.

“Because of APAC’s vast potential for globally significant climate and ecological impact, we expect to see much more private equity investment in renewable energy, high-quality natural capital, and corporations that use technology to reduce carbon emissions in the region,” Siew Kam Boon said.

Tech pushing up valuations

Technology demand has also boosted valuations, pushing multiples

up even further in an already inflated environment. This means

that bargains are few and far between, the report countered, and

this is being most keenly felt in Asia-Pacific, where private

investment in technology, telecoms and media accounted for nearly

half of the region's total deal value.

Mergermarket consulted around 100 senior executives at private equity firms for these insights between April and September this year, with 45 per cent based in North America, 35 per cent in EMEA, and 20 per cent in Asia-Pacific. Dechert began commissioning the outlook back in 2018 to reflect trends in the private equity sector as more investors explored the asset class, through both institutional deals and through a rise in fintechs and specialist investment platforms, which are widening access to mass affluent investors.