Wealth Strategies

Planning, Investing For Longer, Happier Lives - Evercore

Longer lifespans create challenges - but are also situations that HNW individuals should grasp. The US wealth management firm discusses some approaches.

Generally, people are living longer, although diseases such as diabetes and rising obesity in many nations might buck this trend. Regardless of that caveat, the rising lifespans of developed and developing countries are grounds for optimism. But the trend also means that conventional assumptions about saving and investment for retirement need to be reviewed - people will have to work for longer. (That might not be as grim as some might assume, given that a productive life avoids boredom and keeps people mentally sharp. Clearly, however, there are concerns for those doing heavy manual labor where a prolonged working life isn’t viable.)

To address these issues is a senior figure from Evercore Wealth Management and Evercore Trust Company, NA. Ashley Ferriello is a managing director and wealth and fiduciary advisor. This publication is pleased to share these views; we invite readers to respond. They should email tom.burroughes@wealthbriefing.com

Longevity may be the greatest dividend of wealth. At the same time, sustaining a longer life requires greater wealth. Confronting this paradox requires thoughtful planning and investing. Outliving assets is the top financial concern of high net worth and even ultra-high net worth families, and for good reason.

The top 1 per cent of Americans by income now live, on average, 10 years longer than the general population. Women in this segment live to age 89 and their male counterparts live to 87. The gap between the richest 1 per cent of men and the poorest 1 per cent in the United States is currently a remarkable 15 years. The corresponding gap for women is 10 years.

These developments raise broad questions. From a purely planning and investing point of view, however, the most pressing question is how to fund these extended lifespans.

Here are three scenarios to consider, each drawn on actual experiences. The ages, circumstances and goals of the people involved vary, but they have one thing in common with all of us: none of them know how long they – or their spouses – will live.

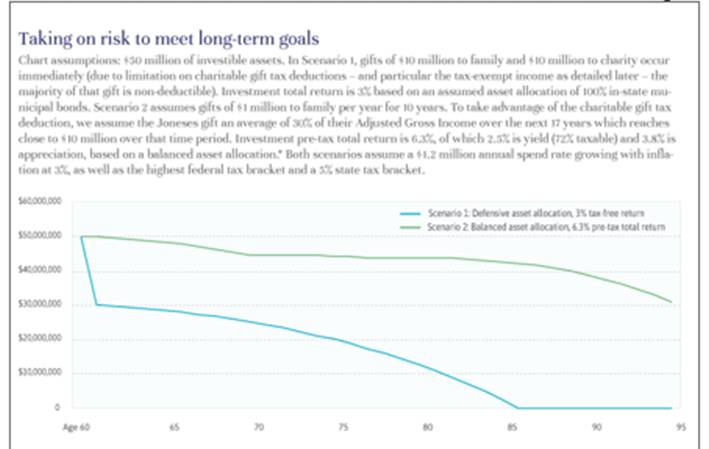

Taking on risk to meet long-term goals

The Joneses, two retired professionals, both age 60, have $50

million in investible assets and are anticipating a long and

enjoyable retirement. They plan to help their grown children buy

homes and start businesses, set aside sufficient funds for their

grandchildren’s education, and dedicate much of their time and

money to their favorite charities. They would like to see these

gifts make an impact during their life – while reducing their

taxable estate – but also want to ensure that they leave a

thoughtful amount to their heirs.

This couple is quite risk-averse with their investments, arguably too much so in the context of their considerable assets and financial objectives. While a conservative annual return of 3 per cent from their largely defensive investment portfolio would sustain the Jones’ lifestyle and their plans until age 85, it is likely that either or both will live considerably longer. If they transfer assets over time and broaden their allocation to include more diversified exposures, notably equities and private illiquid assets with higher projected rates of return, their comfort in retirement and the success of their longer-term goals would be more likely.

In this scenario, if they both died at age 95, the Joneses would leave a substantial amount of assets – $31 million as illustrated below – which may or may not be an appropriate amount for their heirs. During their life, as their financial circumstances remain strong, they may choose to make more gifts, or split the ultimate beneficiaries of their estate between children and charity.

Keeping on, not up

The Smiths, also age 60 and retired, spend even more than the

Joneses do, but without adequate resources to fund them much

longer. While their $25 million would be sufficient for many, the

Smiths live in a high-cost area and are overspending every year,

which means they are drawing down proportionally more and more of

their assets. They have no heirs to leave assets to, but even if

they both live to just 79, the current average for the general

population and well short of their economic peers, their

intervening years could be compromised, as illustrated below. By

about age 74, only 14 years from now, their investment portfolio

is likely to be about half of what it is today.

If, however, the Smiths moved to a low-tax state and reduced their spending by 25 per cent, their outlook brightens considerably and their financed assets should maintain them through their early 90s. Moving away from their neighbors would be an adjustment, but the tradeoff would allow the Smiths to preserve their savings and maintain assets to weather their later years. It’s important to note that their spending remains high, even with these compromises. If the Smiths live into their 90s, well within the realm of possibility, they would be left in a financial predicament. Regularly reviewing their financial plan would help the Smiths address their financial situation and goals.

.jpg)

Investing for longer lives

The Garcias, age 50, are at peak earnings in their respective

careers. Together they have saved $15 million, which they believe

is more than enough to cover their lifetime expenses. They want

to retire now so they can spend more time with their children and

care for their aging parents. However, the Garcias are likely to

live even longer lifespans than their parents, possibly for

another 40 years. Retiring too young could leave them financially

exposed. Working for eight more years could provide the family

with greater security, allowing their financial assets to last

almost 10 more years. If the Garcias want financial protection

for their 90s, or if they feel strongly about leaving assets to

heirs, they should work even longer or consider a reduction in

spending.

This is not “set it and forget it.” A strategic wealth plan should be reviewed regularly, especially during times of change, and against a wide range of goals and market assumptions. Thoughtful, flexible planning and investing – as well as making appropriate spending and giving tradeoffs – can ensure that even the longest lives can be financially comfortable.

Note

*Analyzing expected investment returns across asset classes, as well as potential market drawdowns, helps to determine an appropriate asset allocation. Understanding goals, circumstances and appetite for risk is equally important. The intersection of the two is where thoughtful planning and investing meet. Evercore Wealth Management’s 10-year, pre-tax expected return assumptions are as follows – Defensive Assets: 2.7%, Credit Strategies: 5.2%, Diversified Market Strategies: 4.8%, Growth Assets: 8.0%, Illiquid Assets: 12.3%. Every Evercore Wealth Management portfolio is customized and constructed to meet specific goals. A balanced asset allocation assumes 1% Cash, 22.5% Defensive Assets, 7.5% Credit Strategies, 9% Diversified Market Strategies, 50% Growth Assets and 10% Illiquid Assets.