Family Office

INTERVIEW: Family Offices Embracing "Discoverability" When Sourcing Investment Opportunities

Peter Lehrman of Axial, talks to FWR about how family offices are embracing the notion of “discoverability” when it comes to sourcing investment opportunities.

Editor’s note: Axial is an online network for professionals who operate, advise, finance and acquire private companies. Each week, some 200 private companies share new opportunities with over 13,000 different financial intermediaries, capital providers and strategic acquirers.

The firm counts 90,000 connections made a month among its 17,000 members, which represents around $47 billion currently in active deals. Key members include M&A advisory firms, investment banks, private equity groups, corporate buyers, individual accredited investors, lenders, advisors and - a growing fragment - family offices. In this area, Axial has grown by around 20 per cent over the past year, with the segment representing between 5 and 6 per cent of its overall member base today.

With the digitization of business development and deal sourcing activities making private market investments more accessible, Peter Lehrman, chief executive and founder of Axial, spoke to Family Wealth Report about how family offices are embracing the notion of “discoverability” when it comes to sourcing investment opportunities.

Family offices tend to have what Lehrman described as a “semi-public profile” but, at the same time, they want to be able to put themselves “in the right place at the right time” to net compelling investment opportunities.

Single family offices leveraging multi-family offices

Lehrman noted that there are only a finite number of single family offices carrying out their own direct investment sourcing efforts, with a considerable handful often leveraging the infrastructure of MFOs.

If an SFO has a relationship with, say, JP Morgan or Goldman Sachs, they will be presented with a very specific pre-vetted set of investment opportunities, he said. “JP Morgan can’t go out into the private market and find individual one-off investment opportunities; it’s too expensive, there is too much regulatory risk and they don’t really add value to SFOs from a deal sourcing perspective.”

Axial’s platform is therefore a way for MFOs to differentiate themselves from bigger industry players, he said. “MFOs don’t actually have nearly as much red tape and bureaucracy to fight through in order to find interesting one-off investment opportunities.”

He added: “With an MFO that is smaller and focused on a handful of clients, one of the values they add to the family office community is that they leverage platforms like Axial to find interesting investment opportunities. They then vet and evaluate them, and share them with their SFO clients. That’s a powerful way for the MFO community to differentiate themselves from the big private banks.”

How Axial works

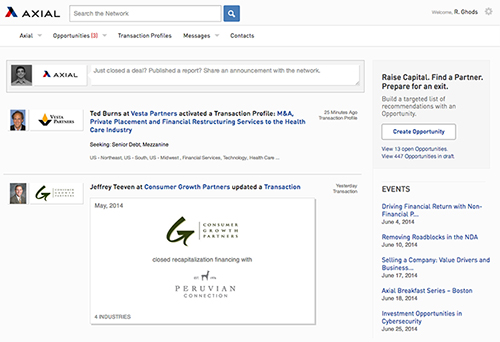

In terms of the layout or structure of the platform, Lehrman likened it to LinkedIn in a sense that members can browse the network and narrow down search criteria to match their investment preferences.

In the event that an MFO decides to evaluate an investment opportunity, it can upload details of the transaction and then Axial’s search engine will generate a list of all the family offices that are likely to be interested, based on industry among an array of other factors.

“All of the family offices on Axial have pre-established their investment criteria and the types of transactions they’re looking for,” Lehrman said.

Another way for an MFO to use Axial is to find the transaction itself on the platform, then if the entrepreneur or business owner on the other side decides to move forward, the MFO can use Axial to syndicate the transaction with other SFOs on the network.

Family offices can see real-time updates on investment opportunities and watch deal activity on the Axial news feed

A tough nut to crack

Lehrman highlighted that family offices tend to prefer “clubbing together” with families and people they know. But the process of establishing a syndicate which then invests in a particular company or opportunity can be very time and labor intensive.

Through Axial, family offices can manage their level of “visibility” so as to only appear in the search engine if their investment criteria directly relates to the transaction being contemplated.

“We’ve built tools that allow family offices to create their own private groups and manage some of those syndication requirements through the platform,” Lehrman said.

Also of note, each network member is a paying customer who has been vetted by the firm, meaning the amount of “noisy” solicitation is very low, he added.

“You only show up in the recommendation search engine if your investment criteria as a family office directly overlap with the transaction in question. Otherwise, your visibility is very low. I think that’s why many family offices have opted to use Axial as their online identity as opposed to building out their own website.”

Case study

One firm on the platform, Branford Castle, invests in small- to medium-sized private companies with up to $75 million in total enterprise value. The firm was founded by John K Castle, chief executive and chairman of Castle Harlan and the prior president and CEO of the investment bank Donaldson, Lufkin & Jenrette. John Castle, the son of John K Castle, said Axial has been “significantly helpful,” particularly as the firm has very specific acquisition criteria.

“Axial is being used widely as a tool by investment bankers and others to list deals they’re working on. It provides us an opportunity to go through the list and find a handful that we can acquire,” he said. “We think it’s much more beneficial to be able to identify all the deals out there, even if other people are going to see them too.”

He noted that one of the drawbacks of being in the lower end of the middle market is that “you don’t know where those businesses are going to show up.”

“A service like Axial, which is great at aggregating a lot of the deals in the lower end of the middle market - and allowing us to source by the types of transactions we’re looking for - has saved us a lot of time,” he said.

Impartiality

Lehrman said Axial doesn’t take any financial interest in any of the transactions closed.

“We do not have an economic incentive for our customers to do deals or not do deals, our goal is to connect them with one another,” he said.

“That neutrality is very important because, if we’re making a lot more money when customers do deals - regardless of how they turn out - there are all kinds of long-term alignment issues we could face.”