Philanthropy

How Wealthy Families Navigate The Choice Of Donor Advised Funds Vs Private Foundations

A prominent expert in the field of philanthropy examines continued debate about the right structure through which families can execute on their charitable wishes.

The author of this item is Susan Winer, Chief Operating Officer and co-founder of Strategic Philanthropy, a firm headquartered in Chicago. Susan is a regular commentator for Family Wealth Report (see a previous article of hers here.) Her firm works solely with high net worth and ultra-high net worth donors, and was established in 2000. In a series of articles, she is setting out some of the most important issues in philanthropy and financial advice, not just for those in North America, but around the world. This news service does not necessarily endorse the views of guest contributors; nonetheless, the editors of this news service are delighted to share these insights and we hope they stimulate debate. Readers who want to send in commentary and feedback should contact the editor at tom.burroughes@wealthbriefing.com

This is the first of two articles around the issues concerning what are called Donor Advised Funds, aka DAFs, and other structures.

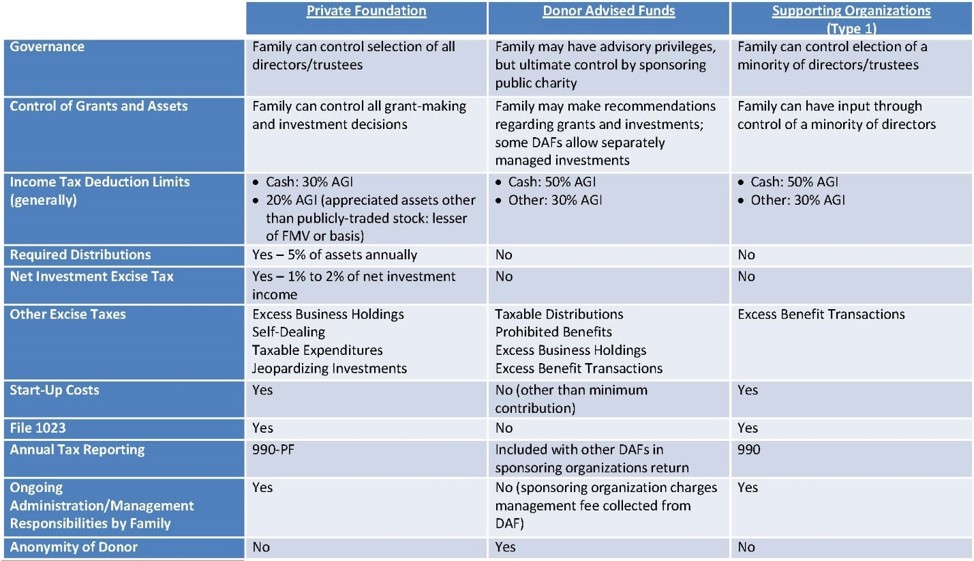

Financial and legal professionals often debate which is the better charitable vehicle: a private foundation or a Donor Advised Fund. Often, the debate centers on costs for creating the vehicle and for its ongoing administration and compliance. But cost should not be the sole motivation; the purpose of the charitable vehicle should also be taken into consideration.

Advisors need to ascertain the client’s intentions and the degree of involvement they want to have when establishing a vehicle. The following chart is a good reference point to share with clients.

Table 1 - courtesy of Jolie Howard, Senior Counsel at Ytterberg Deery Knull LLP, Houston, TX

If the choice is to create a family foundation, then understanding what is involved in order to make a foundation successful and responsive to the family’s interests is an important part of an advisor’s role, and this knowledge can further strengthen the relationship between an advisor and the family. In many ways, the family foundation is another business venture for the family - one that may transcend generations (collectively and separately).

Just as with any business, the family foundation has certain legal and financial requirements imposed by the IRS.

In the case of a foundation, this includes annual filings of the 990PF, and in some instances fees and reports to the individual state’s Attorney General. In addition, there is a mandatory annual minimum payout of five percent, and there must be a board in place, whether composed of family members or other parties. These are the bare bones requirements for the foundation to retain its tax status.

A family foundation is a non-threatening environment for younger family members to learn about family values and how to be a good citizen in their community and the world. It also serves as an excellent training ground to build financial management and decision-making skills as the next generation(s) learn how to evaluate requests for funds; how to work in a collaborative way with other family members; and how to administer a business venture that has both a financial and philanthropic investment portfolio in place.

This kind of integrated educational opportunity can be invaluable as these family members step in to take over the family’s business and financial matters. A successful and well-run family foundation incorporates the necessary operating protocols, monitoring, and compliance functions. It also needs to be responsive to evolving interests and needs of the family. As the trusted advisor, you can help your clients understand what needs to be done once the legal structure is in place.

Your support and guidance will ensure that they get off to the right start. Some of the startup considerations include:

-- A stated mission that addresses the Foundation’s focus in

terms of issue areas and demographics;

-- Clearly articulated protocols for soliciting grant

requests including what kind of due diligence should take place,

and how to ensure adherence to donor intent;

-- An established timeline

or life of the foundation (in perpetuity or with a specific

sunset date;

-- Documented operating and governance parameters that include

criteria and strategy for eligibility and succession of trustees

or board members and how decisions will be made, and by whom;

-- Clear descriptions of the roles and responsibilities of

trustees; and

-- How to support Grantmaking and other administrative

functions.

Some other considerations that may be part of the operational and decision-making model for the family foundation include:

-- Whether the investment

strategy for the foundation should align with the foundation’s

mission and the interests of the family;

-- The kinds of grants the foundation intend to make: single or

multi-year, a one-time gift and whether program specific or for

capacity building or general operating needs;

-- How and when to involve the next generation(s); and

-- What the accountability or evaluation parameters should

be.

Whatever the charitable vehicle - a private foundation, Donor Advised Fund or trust - when advisors help clients to better understand how to integrate the family into the vehicle and vice versa, they demonstrate an understanding of the importance and relevance of the family’s philanthropy to the family.

Simultaneously, they are reinforcing the importance of best practices that will protect both the family and the charitable vehicle as the family pursues their charitable interests.