Alt Investments

HNW Clients Still Not Showing Big Love To Alternatives β BNY Study

For all the hype and commentary about alternatives β a wide term spanning VC to hedge funds and commodities β these areas don't make up a big chunk of HNW portfolios, according to a survey of over 100 wealth managers in the US. But allocations are set to increase, it finds.

While the wealth management industry has been regaled for more than a decade about the merits of alternative investments, a report by BNY finds that less than 3 per cent of HNW portfolios hold these assets.

BNY produced the findings in its Wealth Trends in Alternatives report, based on the views of more than 100 wealth managers in the US.

The survey found that during the coming next 10 years, private wealthy investors will load up on alternatives to $12 trillion from $4 trillion.

Areas such as private credit, equity, forms of real estate, infrastructure and hedge funds have grown in use, albeit with variations, such as during the pandemic and when interest rates spiked after lockdowns ended in most nations in 2021. A decade of ultra-low rates after 2008, along with structural shifts from public listed markets, has driven inflows into the area. And with hedge funds, their famed ability to deliver results in sometimes difficult markets, remains an attraction, although the sector has seen fee compression from 20-plus years ago.

This news service has noticed how large firms in the private markets area, such as Carlyle, Blackstone and KKR, have built out private wealth arms, as they see HNW and UHNW individuals, including family offices, as important sources of growth.

Among details of the BNY paper, it found that 84 per cent of survey participants using alternatives expect their target allocation to increase in a yearβs time; 52 per cent think it will be significantly higher.

The greatest growth is likely to be in natural resources, hedge funds and real estate investment trusts, with 61 per cent, 62 per cent and 66 per cent, respectively; allocations to private equity are expected to grow for 63 per cent of respondents, though more expect this increase to be only slightly higher.

Diversification of returns and increased return potential are equally the greatest drivers for future investment according to respondents, with 84 per cent selecting both as reasons for anticipated increases.

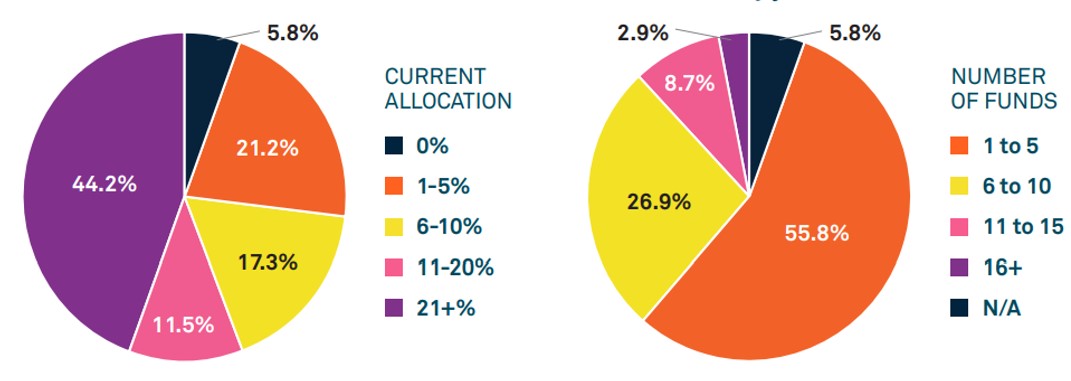

The vast majority of respondents (94 per cent) have already

allocated client portfolios to alternatives. Of those, 44 per

cent reported allocating over one-fifth of private client

portfolios to alts (see charts below), supporting the apparent

trend of wealth managers moving away from traditional

60/40 portfolios (60 per cent equity, 40 per cent bonds)

toward more diversified asset allocations. Only 6 per cent

of respondents reported not having a current allocation to

alternatives.

Source: BNY

Obstacles

There are challenges to overcome. Respondents to the BNY survey

said the largest operational barriers for clients in entering the

field are complying with legal and regulatory requirements and

managing manual documents. Confirming a legal, risk or compliance

matter was viewed by 51 per cent of respondents as being harder

than in the traditional investments space.

The most time-consuming part of the subscription document/order entry form process, according to 78 per cent, is completing a legal, risk or compliance matter. This was followed by verifying investor data and completing numerous manual fields at 66 per cent and 51 per cent, respectively.