Investment Strategies

GUEST ARTICLE: Five Reasons to Invest in Small/Mid-Caps Now

Go for small- and mid-scap stocks if you want to find value in the US equities market, this article argues.

With all the talk about how the US equity market is looking expensive after almost a decade's bull run since the end of the financial crisis of 2008, the question arises as to where the value is. One such area, so the authors of this article claim, is that of small- and mid-cap equities. The authors are from JOHCM: Thorsten Becker, Arun Daniel and Vince Rivers. (Their biographies are below). The editors of this news service are pleased to share these views with readers and invite responses; as ever, they don't necessarily share the views of outside contributors. Email tom.burroughes@wealthbriefing.com

Through June 19, 2017, large-cap stocks have been leading the charge among US equities, with the S&P 500 Index up more than 9 per cent year to date, compared with the Russell 2500, which has gained about 5 per cent. With the run-up in large-cap names, advisors may want to look elsewhere for opportunities.

While they may not be established household names or the hottest new startups, U.S. smid-cap stocks, which we define as having a market capitalization between $1 billion and $10 billion, can offer investors some compelling opportunities. This asset class is often overlooked -it doesn’t have its own formal Morningstar US equity category -but we see at least five reasons why smid-caps should have a spot in most portfolios.

First, smid-caps are in the proverbial “sweet spot” of their life cycles. Many innovative firms in the space are past the tentative and often volatile early stage of new businesses, and as such, they have real products and revenues. As they achieve rapid growth and reach critical mass, many of the most promising companies either become new market leaders or takeover targets. Today’s smid-caps are tomorrow’s large-caps, as evidenced by the trajectories of firms like Netflix (which grew from a $500 million market cap in May 2002 to $66 billion by June 2017) and Salesforce (from $2.7 billion market cap in June 2004 to $61 billion in June 2017).

.png)

Second, smid-cap investors are exposed to more upside potential.

They can own winners longer and extract a larger percent of the

gains than small-cap investors, who sell stocks once they reach a

certain market-cap level. Smid-cap funds also have fewer capacity

constraints than their smaller-cap cohorts, as liquidity is more

readily available. As shown in the chart below, smid-caps,

as represented by the Russell 2500 Index, have consistently

outperformed small-caps (Russell 2000) and large-caps (S&P

500) as well as international stocks (MSCI ACWI).

Third, because of the vast universe of equities in the asset class, smid-caps are an inefficient, under-researched market segment, which provides rich opportunities for alpha capture. According to a recent paper from Lazard Asset Management, an average of seven sell-side analysts covers a typical smid-cap stock, versus 22 analysts for its large-cap counterpart. In particular, the US is fertile ground for innovative smid-cap firms, as the expansive US market makes it easier to try out new concepts, services and technologies and to target specific market segments.

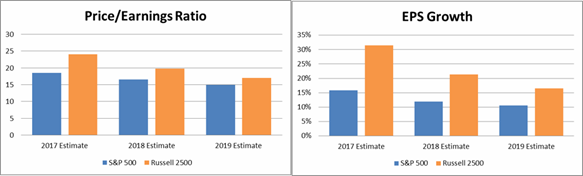

Fourth, the smid-cap space has a definitive bias toward growth, which is particularly attractive in the current U.S. environment. According to Morgan Stanley, with 97 per cent of the S&P 500 market cap having reported results, companies exceeded consensus estimates by almost 6 per cent, with year-on-year earnings growth of 15 per cent in the first quarter. While at current levels, smid-caps do not look cheap on a price-to-earnings basis, investors are paying a slight premium for significantly greater growth potential vs. larger-cap counterparts.

Source: Bloomberg as of May 25, 2017

Finally, the political and regulatory climate may be shaping up to support smid-cap companies. We estimate that smid-cap firms do about 70 per cent to 80 per cent of their business domestically, compared with about 50 per cent to 60 per cent for large-cap companies. This translates into a significantly higher tax rates for US smid-cap firms, so if the Trump administration succeeds in cutting corporate tax rates, it would have a disproportionately larger benefit for smid-cap firms. Loosening domestic regulations would also have a positive impact on the asset class, as the costs of regulatory compliance can be quite exorbitant for smaller firms. Of course, no one knows exactly which policy proposals will ultimately pass Congress or when that might eventually happen, but any versions of these reforms - even compromises - could help to bolster some smid-cap share prices.

Although we clearly have a favorable view on the smid-cap equity

space, we believe an allocation to the asset class as part of a

broadly diversified portfolio of investments is the optimal

approach. How much to allocate depends on an investor’s risk

tolerance and time frame, but a lack of allocation could result

in missed opportunities. To us, a zero weight to smid-caps is

almost like a bet on a bear market.

Disclaimer:

The strategy does not hold any positions in the stocks mentioned.

The views expressed are those of the portfolio manager as of June 2017, are subject to change, and may differ from the views of other portfolio managers or the firm as a whole. These opinions are not intended to be a forecast of future events, a guarantee of future results, or investment advice.

About the authors:

Thorsten Becker is a senior fund manager on the JOHCM US Small

and Mid Cap Equity and the JOHCM Global Smaller Companies

Strategies. He previously served as a portfolio manager at

Fidelity Institutional Asset Management (formerly Pyramis Global

Advisors), a unit of Fidelity Investments. In that role, he

managed the global financial sector portfolio. Before the

formation of Pyramis in 2005, Thorsten worked in the same role

with Fidelity Investment’s institutional equity group. Since

January 2004, he managed the financials and telecommunications

sectors of team-managed large cap, small/mid cap, and 130/30

strategies. Thorsten served as an Equity Analyst in Fidelity’s

London office from 2000 to 2003, covering the securities of

European banks, emerging market financial companies, and European

business services firms. Prior to that, he covered Latin American

equities, researching the retail, metals & mining, and utilities

sectors while based in Fidelity’s Boston office from 1996 to

2000.

Arun Daniel is a Senior Fund Manager of the JOHCM US Small and Mid Cap Equity and the JOHCM Global Smaller Companies Strategies. He previously served as a Portfolio Manager at Fidelity Institutional Asset Management (formerly Pyramis Global Advisors), a unit of Fidelity Investments. In that role, he managed the global consumer sector portfolio. Prior to assuming that role in 2007, Arun was Vice President and Sector Head for the consumer sector at ING Investment Management, North America, managing growth, value, and 130/30 portfolio strategies. He was a Senior Equity Analyst and Portfolio Manager for the consumer sector of a hedge fund portfolio at Principled Capital Group, and had responsibility for fundamental sector research in the entertainment, gaming, lodging, leisure, and retail sectors. Arun has also served in senior management roles in the entertainment, retail, and resort divisions at Walt Disney Company. He has more than 15 years' experience in the investment industry and 25 years' experience related to the consumer sector.

Vincent Rivers is a Senior Fund Manager of the JOHCM US Small and Mid Cap Equity and the JOHCM Global Smaller Companies Strategies. He previously served as a Portfolio Manager at Fidelity Institutional Asset Management (formerly Pyramis Global Advisors), a unit of Fidelity Investments. In that role, he managed the global information technology and telecom sector portfolios. Vince joined Pyramis in 2006 as a Research Analyst focusing on the information technology and telecom sectors. Prior to joining Pyramis, he was a Portfolio Analyst at Wellington Management Company, LLP from 2004 to 2006. He also has served as an Equity Research Analyst at Fidelity from 2000 to 2004 and, as a Portfolio Manager of the Fidelity Select Paper and Forest Products Fund from 2001 to 2004. He also has held positions at Fleet and BayBanks in Boston.