Asset Management

GUEST ARTICLE: An Active Debate On Passive Investing

.jpg)

The author of this article argues that active management should be at the core of an overall equity portfolio.

One of those issues that won't go away is the argument around the case for passive and active investment. The past few years have seen an explosion of growth in passive, low-cost funds, although there remain plenty of those who argue that the asset management process remains in thrall to the desire to chase "Alpha". No less a figure than Warren Buffett earlier this year took aim at hedge funds and said there was more sense to holding a tracker fund. But there are those who argue that the case for passive investing is not cut and dried, and that the very word "passive" can be misunderstood.

To address this issue is John Tennaro, senior vice president

and senior investment analyst at

CIBC Atlantic Trust Private Wealth Management. To

respond, readers can email the editor at tom.burroughes@wealthbriefing.com

There have been many existential debates about the “optimal” way

to invest: growth stocks vs. value stocks, international vs.

US-only portfolios, and the list goes on. This type of discussion

tends to crop up after one type of investment outperforms another

type for a period of time, which leads some to declare that

today’s winner will remain superior for years to come. Today’s

hot topic is active management vs passive management. In this

article, we examine the respective merits and drawbacks of both

of these styles of investing, as well as the CIBC Atlantic Trust

selection approach for finding investments that we believe will

stand the test of time.

Unmasking of passive investing

It is no secret that passive investing has become extremely

popular in recent years, with the amount of money going into

passive investments doubling in size since 2013 to over $6

trillion. Furthermore, passive investing has seen its market

share of assets under management in the US skyrocket from 25 per

cent to 40 per cent during the same period.1 Clearly, the

transparency and affordability of passive funds aided by

technology have spawned tremendous growth in exchange-traded

funds and the indexed mutual fund industry, often at the expense

of active management. Passive investing has disrupted the status

quo, providing worthy competition to those focused on “beating

the market.” However, it is important for investors to understand

the nuances of passive investing in order to avoid unintended

consequences.

Passive funds focus primarily on closely tracking stock market

indices, such as the S&P 500 index among many others. The

indexes themselves are rules-based, initially created as a means

of monitoring broad stock market performance. Thus, the holdings

in an ETF or index fund are pre-determined with no regard for the

characteristics or quality of the underlying businesses. This is

in stark contrast to our view of stocks as partial ownership

stakes in the future profitability of companies. By handing over

the decision-making process to a set of index rules, passive

strategies can take on unintended biases that increase investors’

exposure to potential risks.

Exhibit 1: The rise of the benchmark

*Bloomberg LP (which owns Bloomberg Businessweek) and its

affiliates provide indexes tracking various asset classes.

Source: Bloomberg Intelligence, Sanford C. Bernstein, World Bank,

Cash Flows as of March 31, 2017; Graphic by Bloomberg

Businessweek.

The growing popularity of index-based investing is best

illustrated by the chart above -there are now more benchmarks

than there are individual stocks! In part, this is a reflection

of some of the unique characteristics of this post-Great

Recession bull market. Coming off depressed valuations, and

supported by extraordinary policy measures from the Federal

Reserve, equity markets have enjoyed well above average returns

since the lows of 2009. The S&P 500 has compounded at a total

return of 18 per cent annually in this eight-year bull market -

some six percentage points above the long-term average annual

return.2

“Settling” for the index return when it is above average - and paying lower management fees in the process - seems like a good deal. Indeed, it has been. The massive flood of liquidity provided by the Federal Reserve produced a rising tide in equity valuations, without much discrimination between stocks in the marketplace. This made it exceedingly difficult for most active managers - focused on company fundamentals - to keep pace. Despite the general challenges for active managers, we are happy to report that CIBC Atlantic Trust’s key equity strategies - Disciplined Equity, Mid-Cap Growth and Master Limited Partnership (MLP) separate account composites - have outperformed their benchmarks since 2009—the year in which this bull market began.3

Fund flow data suggests that many investors are extrapolating the tail wind for indexing as the “new normal.” We believe this is a mistake. While the timing is unknown, by definition, periods of above-average equity returns are followed by below-average returns. The Federal Reserve has shifted from ever-more-generous interest rate and liquidity policies to a path of gradually withdrawing these market-friendly supports. We do not believe “owning the market” through an index fund will be nearly as rewarding in the years ahead. As is discussed in the paragraphs that follow, fundamentally driven active managers often shine during more challenging market environments.

As Warren Buffett stated, “A rising tide tends to lift all boats, but when the tide goes out you get to see who’s been swimming naked.” This might be best exemplified in the small-cap space, where an astounding one-third of stocks in the Russell 2000 have been unprofitable over the past year.4 Yet, these inferior companies - simply because they are in the same index with the high-performing stocks - get the benefit of elevated valuations. The problem is that when the inevitable correction comes, overvalued stocks will likely be the most at risk. After years of accumulating excess returns, passive investors that have enjoyed the momentum on the way up may have an unbalanced portfolio on the way down.

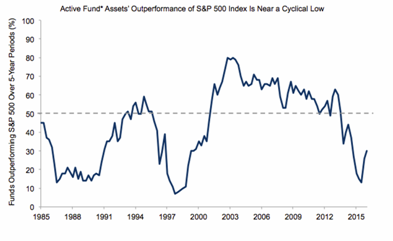

As the chart below illustrates, over the last 30 or so years, there have been many time periods in which most active managers outperform their benchmarks. It also indicates that active management has underperformed - and, in a sense, is “undervalued”- in what has been a reversion to the mean relationship over the years.

Exhibit 2: Active vs passive - passive: a cyclical

relationship

*Active funds exclude those funds/managers that are non-indexed,

enhanced indexed and/or are otherwise passive strategies. Source:

FactSet Style, Performance and Risk (SPAR). Data as of

12.31.2016.

So far, we have focused on the simplest form of passive investing

- mimicking a broad and well-known market benchmark (e.g.,

S&P 500). But the financial services industry is cranking out

hundreds of other products - usually in ETF form - that are more

esoteric and risky, less diversified, and carry higher fees. The

Obesity ETF (“SLIM”) and the Whiskey & Spirits ETF (“WSKY”) are

among the growing list of eccentric ETFs that appear to be as

much about branding as investing. In other words, navigating the

passive management landscape is becoming more complicated as

purveyors create indices for increasingly arcane niches of the

market. Just as with active managers, all index funds or ETFs are

not created equal, and thorough due diligence is needed.

How active management can succeed

Advocates of passive investing frequently quote studies that suggest active managers routinely underperform, an assertion that can be quite misleading. These studies typically include self-described active managers that are really closet indexers - those who construct portfolios that differ very little from the index but still charge active management fees. If these closet indexers are included in the sum of active managers, they will lower the average performance and further support the claim that “the average active manager does not outperform.”

Exhib 3: Returns for high-conviction managers beat closet indexers

Source: Morningstar. Data as of 04.30.2017.

In our opinion, active managers that use contrarian thinking to

construct portfolios consisting of high-conviction companies have

a decisive advantage. These managers are typically “benchmark

agnostic” - meaning they invest with the intent of being

independent of an index. As a firm, we strongly believe that this

group of active managers provides investors with the greatest

opportunity to achieve their long-term goals. And as Sir John

Templeton famously said, “It is impossible to produce superior

performance unless you do something different from the majority.”

One of the basic principles for achieving long-term investment success is capital preservation. We believe active managers can add significant value by managing risk in a way that mitigates losses during turbulent and declining markets. It is clear that sizable losses need even larger gains to recover - for example, a 50 per cent loss requires a 100 per cent gain to break even. Given that active managers tend to look different from the index, this gives them the potential to reduce the negative impact of a down market and be more successful in protecting investors’ capital. During the Tech Bubble, 63 per cent of US equity active managers outpaced their benchmark, while 54 per cent outperformed during the recent Great Financial Crisis.5 This downside protection does not come without cost, however, as risk- and valuation-sensitive active managers often lag during very bullish or euphoric phases of the market cycle.

Conversely, a passive index strategy is designed to capture close to 100% of the upside during a rising market in return for capturing the entire downside of a declining market. Passive funds underperform the benchmark 100 per cent of the time, because unless they are taking some type of active bet, by definition, they fall short of the index after fees. The CIBC Atlantic Trust Multi-Manager Investment Program team thoroughly weighs the costs and benefits of any investment - and continues to believe there is real value to an active manager’s flexibility to anticipate and react to risk. This aligns well with what we hear regularly from clients - making money is important, preserving wealth is essential.

Not surprisingly, all of this underscores the importance of manager research and having a thoughtful and disciplined selection process. Picking an investment manager can sometimes feel like shopping at the grocery store - where it seems there are unlimited choices that leave you feeling overwhelmed. After all, there are around 30,000 mutual funds and ETFs out there. Due diligence is the heart and soul of investment selection - which carries the task of narrowing down the universe of available choices to just those strategies that meet the highest standards. At CIBC Atlantic Trust, we analyze historical data thoroughly while creating a forward assessment of a manager’s competitive edge, which results in identifying managers that we believe can succeed in a range of market conditions.

The debate over whether to use active or passive investing is frequently pitched as if it has to be an either/or decision. We reject that. For many investors, the two styles can co-exist nicely in a diversified portfolio as long as there is a well-defined rationale for each. Even John Bogle, the founder of Vanguard and often called the godfather of passive investing, recently said “If everybody indexed, the only word you could use is chaos, catastrophe.”6

On balance, we remain persuaded that active management - as we define it - is best suited to form the core of an overall equity portfolio when considering both the potential for returns and risk. This is particularly true in the years ahead, when some of the unintended consequences of index funds may come to light as the long bull market gets more challenging, and eventually fades.

Notes:

1 Morningstar, 02.28.2017.

2 FactSet,04.30.2017.

3 CIBC Atlantic Trust strategy composite total returns net of

fees from 3.31.2009 (end of the month in which the bull market

started) to 4.30.2017.

4 Strategas, 05.22.2017.

5 Morningstar/PGIM Investments.

6 Financial Times, 05.18.2017.

About the author: John Tennaro is a senior investment analyst in CIBC Atlantic Trust Private Wealth Management’s Boston office with more than 19 years of industry experience. Tennaro is responsible for investment manager due diligence and selection within the Multi-Manager Investment Program’s traditional investments team.