Family Office

Family Offices Must Gear Up For Bigger Investment Deal Sizes – PwC

The 57-page report from the professional services and accountancy giant delves into data from what it says are around 11,000 family offices around the world. PricewaterhouseCoopers says family offices must raise their capabilities to handle larger deal sizes.

Family offices must develop more operational expertise and resources to keep up with a recent trend toward doing more large-scale investment deals in areas such as private equity and direct holdings, according to PricewaterhouseCoopers in a new study.

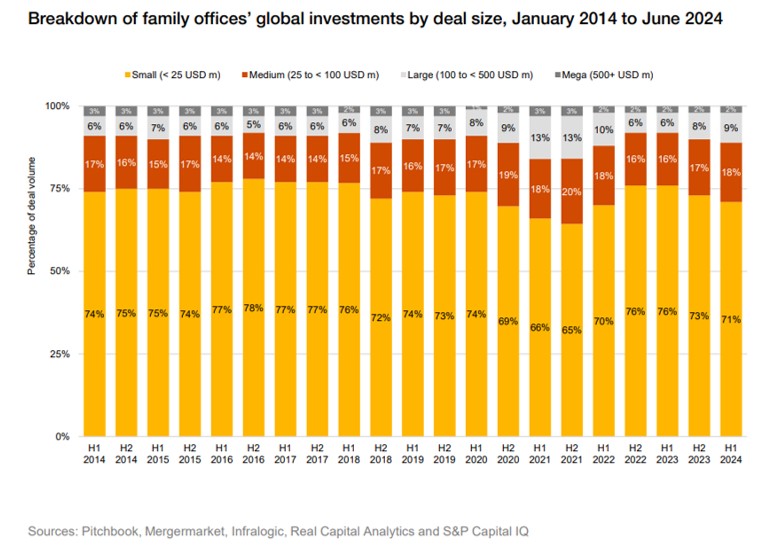

The Family Office Deals Study finds that while smaller investments still represent the majority of transactions, their share has declined by 12 percentage points over the last decade.

PwC analyzed 11,000 family offices that it has been able to identify, tracking acquisitions, disposals and fundraisings between January 2014 and June 2024; the family offices are based in North America, Latin America and the Caribbean, Europe, the Middle East and Africa, and Asia-Pacific.

“As family offices handle growing deal sizes, sector complexity and the push for both financial and societal returns, the ability to build operational maturity, define impact goals and form strategic partnerships will be central to long-term success,” the 57-page study says.

After the first half of 2022, when the share of all large and “mega” deal sizes ($100 million to up to $500 million+) was 12 per cent, that percentage dipped but has risen, now at 11 per cent (see chart below)

Source: PwC Global Family Offices Deals Study

Decline has bottomed out

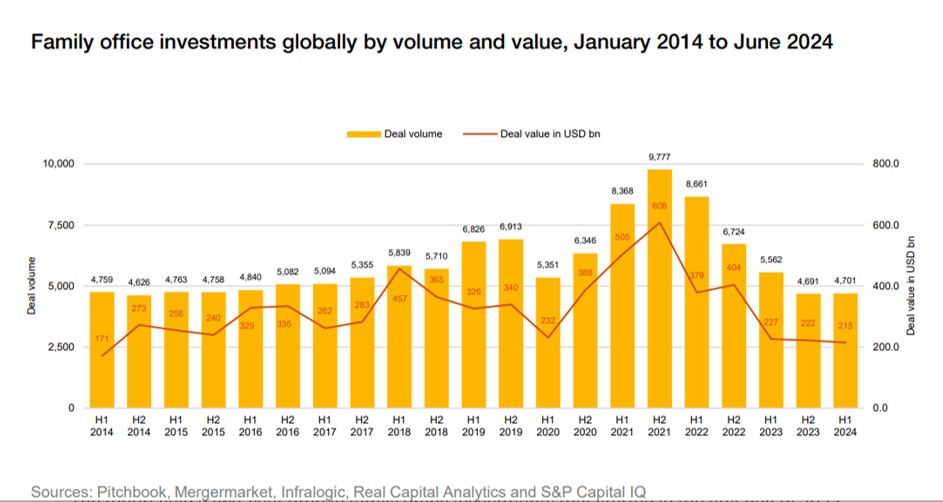

The report said a two-year drop in family office investments that

started in the first half of 2022 (see chart below) now “appears

to have bottomed out,” with deal volume and value having now

stabilized. The number of investments hardly changed between the

second half of 2023 and the first half of 2024, rising by just

0.2 per cent, it says.

Source: PwC

Exits by family offices have “predominantly exceeded investments during the past decade”; aggregate deal value of these exits has generally surpassed their expenditure on new investments, sometimes significantly – which suggests returns are healthy, it continues.

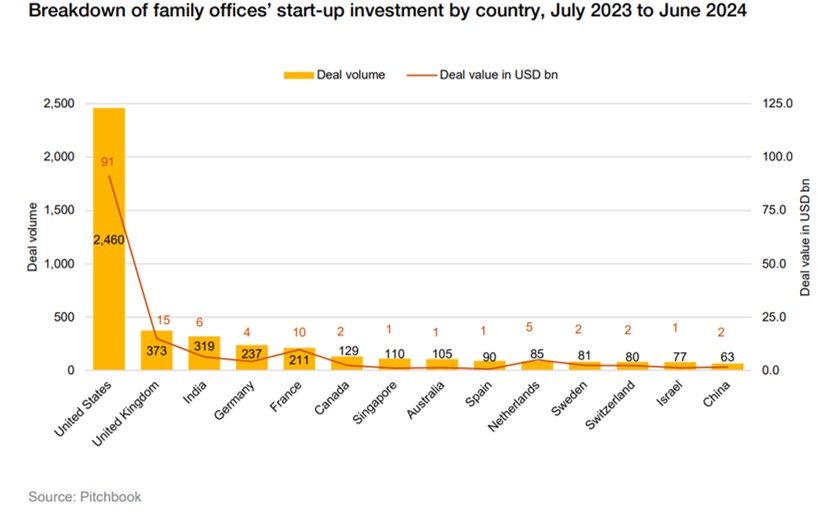

From a regional point of view, the US remains the most important target market for family office investments worldwide, with a deal share at 47 per cent. Europe has lost ground of late, with its share declining.

Bricks and mortar

Real estate investing is receiving renewed interest from family

offices, particularly in the multifamily and industrial

subsectors. After a period of declining allocations, real estate

is regaining prominence as family offices seek opportunities for

income growth and long-term value amid shifting market dynamics

and more favorable pricing conditions, it says.

In other details, the PwC study says impact investing continues to grow, with 54 per cent of US family offices now engaged in the space – double the participation seen in 2015. Key sectors include healthcare, education and renewable energy.

Club deals have emerged as the dominant investment model, accounting for over 70 per cent of US family office transactions, PwC says. These collaborative structures allow family offices to co-invest alongside trusted partners, gain access to larger opportunities and diversify risk – provided strong alignment, governance and transparency are in place, it says.

One of the most striking results is how the US completely dominates family offices’s startup activities, as the following chart shows.

Source: PwC