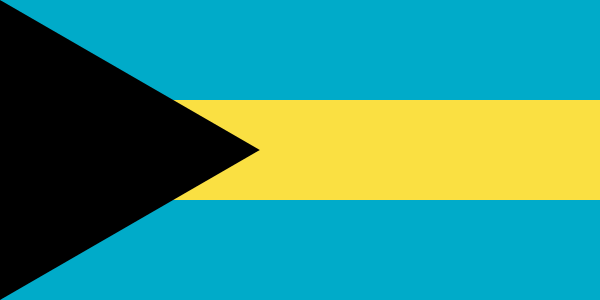

Offshore

EU Gives The Bahamas Clean Bill Of Health

After months of talks, The Bahamas announced that it has been removed from a list of countries deemed un-cooperative for tax purposes, helping it push up the ranks of those deemed to be fully compliant. The move is a boost for the jurisdiction, still recovering from the hurricane last fall.

Following a series of reforms, the European Union has now removed The Bahamas from a list of non-cooperative jurisdictions for tax purposes.

This was effected by the EU’s Economic and Financial Affairs Council after a meeting in Brussels yesterday, according to a statement from the Central Communications Unit, Ministry of Finance in the country.

In March last year the EU put The Bahamas - which operates under English common law and is an independent state - on the EU’s Annex II “the grey list”.

While being included on the list is less serious than being on the “Annex I black list” of the EU list of non-cooperative jurisdictions for tax purposes, the categorization still meant that The Bahamas was being monitored by the EU to see whether it was putting economic substance requirements into force. (“Substance” relates to steps that providers of entities such as trusts and companies must show to prove that they are involved in actual commercial/economic activity and are not just an empty shell for tax or other purposes.)

“With today’s move, The Bahamas has addressed all of the concerns on economic substance, removal of preferential exemptions and automatic exchange of tax information,” the statement said.

“This news of our removal from the EU list affirms that The Bahamas takes its position as a global financial centre very seriously. Coming off this list was not an easy process. We engaged many stakeholders and executed a comprehensive strategy to not only address the EU’s concerns but also to defend the jurisdiction against recent attacks on the legitimacy of our financial services business,” said Kevin Peter Turnquest, Deputy Prime Minister and Minister of Finance.

The statement said that figures from the government’s technical advisor team met with the EU’s Code of Conduct Group to engage in discussions on the integrity of The Bahamas’ tax governance measures. Most of the discussions centered on the introduction of economic substance requirements for investment funds.

Reaction

The Bahamas Financial Services Board and Association of

International Bank and Trust Companies in the Bahamas welcomed

the EU’s move.

“This was done in recognition of The Bahamas having implemented all of the necessary reforms to meet the EU criteria on tax governance and tax cooperation. The move by the EU underscores The Bahamas’ commitment to adhere to global regulations and international best practices as a premiere international financial center. The decision acknowledges that The Bahamas has implemented all the necessary reform to address concerns regarding economic substance, removal of preferential exemptions and automatic exchange of tax information,” the groups said.

The Bahamas was one of 16 jurisdictions that the EU determined had passed legislation to meet EU tax good governance principles, while four new jurisdictions were added to the list of non-cooperative tax jurisdictions, the organizations said.

Getting a clean bill of health from the EU will also be a welcome move for a jurisdiction still coping with the devastation of last year's Hurricane Dorian. (The publisher of this news service has also issued a report in conjunction with The Bahamas about its financial services offerings.)

Meanwhile, a campaign organization that continues to condemn tax evasion and forms of avoidance, the Tax Justice Network, has awarded the Cayman Islands the dubious honor of being the world’s most secretive jurisdiction. The Bahamas, a nearby Caribbean jurisdiction, does not figure in the top ten.